| Back to e-WV

| Back to e-WV

The West Virginia Encyclopedia

The West Virginia Encyclopedia

| Back to e-WV

| Back to e-WV

The West Virginia Encyclopedia

The West Virginia Encyclopedia

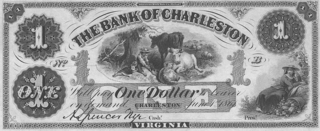

The early history of banking in West Virginia is closely tied to the banks of Virginia. Before the creation of our state in 1863, several banks chartered by Virginia had branches within the present bounds of West Virginia.

These included the Bank of Virginia at Richmond, incorporated in 1804 with a branch later established in Charleston. The Northwestern Bank of Virginia in Wheeling was chartered in 1817. It had branches in Parkersburg, Clarksburg, and Wellsburg. The Bank of the Valley in Virginia, chartered in Winchester in 1817, had branches in Charles Town, Romney, and Moorefield. The Merchants and Mechanics Bank in Wheeling was incorporated in 1834 and had branch offices in Morgantown and Point Pleasant. The Exchange Bank of Virginia in Norfolk was established in 1837, with branches in Weston and Lewisburg. There were private banks as well, operating without charter, and some residents relied on banks in neighboring states.

West Virginia passed no state banking laws until 1872. In the meantime, between 1863 and 1872, some of the old Virginia banks were transformed into national banks under 1864 federal banking legislation, and some closed. Under this legislation, the First National Bank of Parkersburg, formerly a branch of the Northwestern Bank of Virginia and now United Bank, became the first national bank in West Virginia in 1864. By the end of 1865, 13 banks had become national banks, including banks at Martinsburg, Wheeling, and elsewhere. On December 26, 1872, the legislature passed West Virginia’s first general banking law. Numerous state banks were established before this act was repealed in 1881. From 1881 until 1901, banks were created under law governing joint stock companies.

The legislature created a state banking department in 1891, and authorized the governor to appoint a bank examiner. The agency’s authority included state-chartered banks and similar institutions, but not national banks. Similar lines of authority apply today. The West Virginia Division of Banking oversees state-chartered financial institutions, which are also examined by federal authorities. All national banks are overseen by a bureau of the U.S. Treasury Department.

In 1891, there were 49 state banks and 22 national banks in West Virginia. The number peaked in 1924, with 225 state banks and 125 national banks, for a total of 350 banks. In 1933, after the Great Depression had taken its toll, there remained only 103 state banks and 78 national banks.

The Great Depression was the most disastrous event in West Virginia banking history. Bank failures began even before the stock market crash, as 13 banks closed in the late 1920s. Between the stock market crash in October 1929 and the end of 1933, 68 state banks and 25 national banks closed in West Virginia. Some communities were left without banks. Confidence was restored when Congress passed the Banking Act of 1933. This legislation created the Federal Deposit Insurance Corporation to insure bank deposits.

Following the Depression, banking enjoyed an era of recovery that continued through World War II. Banks grew in strength, in part because of the demand for the state’s resources, including coal, and for its chemicals and manufactured goods. Through the late 1940s and early 1950s, West Virginia banks also benefited from a national boom in consumer borrowing. Then, in the mid-1950s, another economic crisis hit West Virginia with the loss of mining jobs and mass migration from the coalfields. Some smaller banks were forced to close. Between 1960 and 1970, there was renewed growth in the West Virginia banking industry. The number of state banks and national banks increased, and deposits in both nearly doubled.

By this time, Mountain State banking had a distinctly dual character. Large banks operated in Charleston, Huntington, Wheeling, Weirton, and Parkersburg, as well as other cities and large towns. Smaller towns and less populous counties had their local banks, smaller but often thriving institutions. Branch banking was prohibited under a 1929 state law, protecting local institutions from the competition of metropolitan banks. The legislature confirmed the prohibition in 1972, but allowed banks to operate one off-premise site (either a walk-in or drive-up facility) within 2,000 feet of the main office.

The branch banking issue—as well as the related questions of mergers, bank-holding companies, and interstate banking—divided West Virginia bankers. Small bankers joined the Independent Bankers Association to oppose branch banking. Those who supported branch banking joined the Progressive Bankers Association. The West Virginia Bankers Association tried to take a neutral stance, but eventually supported branch banking.

As late as 1980, banks could not operate automated teller machines off their premises. Branch banking was still not allowed, nor could banks offer services beyond the traditional lending and deposit taking. Multi-bank holding companies and interstate banking did not exist in West Virginia. That year, Congress passed the Depository Institutions Deregulation and Monetary Control Act, which deregulated interest rates paid by banks and allowed savings and loan institutions and credit unions to offer many services previously offered only by banks. Under federal deregulation, there was more competition among banks. At the same time banks began to face competition from other financial institutions.

In 1982, Governor Rockefeller called for broad changes in the state banking system. Resulting legislation allowed the formation of bank-holding companies, so that one company could own several banks, but banks themselves were not allowed to merge, combine with, or consolidate into other West Virginia banks or banks from outside West Virginia. County-wide branch banking was allowed after June 7, 1984. After January 1, 1986, statewide branch banking was allowed.

Changes in state banking laws and federal deregulation brought a dramatic restructuring of banking in West Virginia. Large banks established bank-holding companies, acquiring smaller banks and eventually each other. Relaxation of interstate banking laws allowed out-of-state banks to acquire branches in West Virginia, and West Virginia banks to acquire branches in other states. A few very large banks emerged, and some of these were later acquired by banks outside the state. For example, Centurion Bancshares, including Charleston National and other banks, and Key Bancshares, including First Huntington and other banks, eventually became part of Bank One of Chicago. National Bank of Commerce became part of Huntington Banks of Columbus, Ohio. In 2000, One Valley Bank (formerly Kanawha Valley Bank), the largest bank in West Virginia, was acquired by BB&T, a North Carolina bank. Other large banks, including United and Wesbanco, have not merged with out-of-state banks.

The number of banks fell dramatically with the mergers and combinations. By 1990, there were 180 commercial banks and 15 savings institutions headquartered in West Virginia; 66 commercial banks and six savings institutions in 2005; and 63 commercial banks and six savings institutions in 2020, the most recent data available. Control of West Virginia banking rested in fewer hands than previously, and some of the largest banks were headquartered outside the state. Bankers competed in a variety of fields, including insurance and brokerage services, that would have surprised their predecessors. In 2020, more than $36 billion was on deposit in West Virginia financial institutions. Banks in West Virginia are regulated by the West Virginia Division of Financial Institutions (previously known as the State Banking Department and then the Division of Banking), and must comply with state and federal laws and regulations. Banks are represented by the West Virginia Bankers Association and the Community Bankers of West Virginia.

Rice, Otis & Stephen Brown. A Centennial of Strength: West Virginia Banks. Charleston: West Virginia Bankers Association, 1991.